Financial Modeling

Unique Training with Vision Integrity & Commitment to Serve the World

Financial Modeling

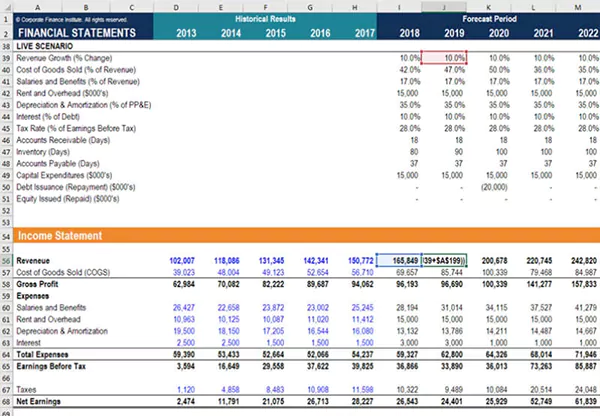

At PIBM, students who are pursuing Finance specialization undergo complete financial modeling training involving the collection of relevant financial data about the businesses to be modeled and the representation of these data so that important calculations about the company can be made, such as valuation.

Following aspects of financial modeling are covered in this process:

Training starts with learning the most effective ways to design, cross-check and structure financial models

Students gets practical experience in various steps in building robust and flexible financial models

Training is provided on how to create and compare scenarios – base case, best case, worst case

Students develops understanding on how to prepare realistic and reliable financial forecasts

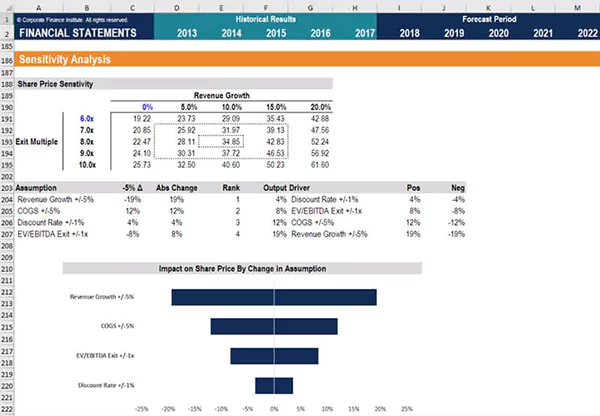

Students also learn how to determine a fair value of a company or other asset

Use of various case studies helps to understand various types of modeling - Financial Modeling, Valuation, Modeling, Merger Modeling & Leveraged Buyout (LBO) Modeling

How It Helps?

By the end of 2 yr. program and financial modeling training PIBM students:

Learn how to quickly, efficiently and effectively evaluate financial decisions when undertaking a project, making an investment, acquiring or disposing of a business

Develop expertise on testing how assumptions fit into business plans with the help of a financial model